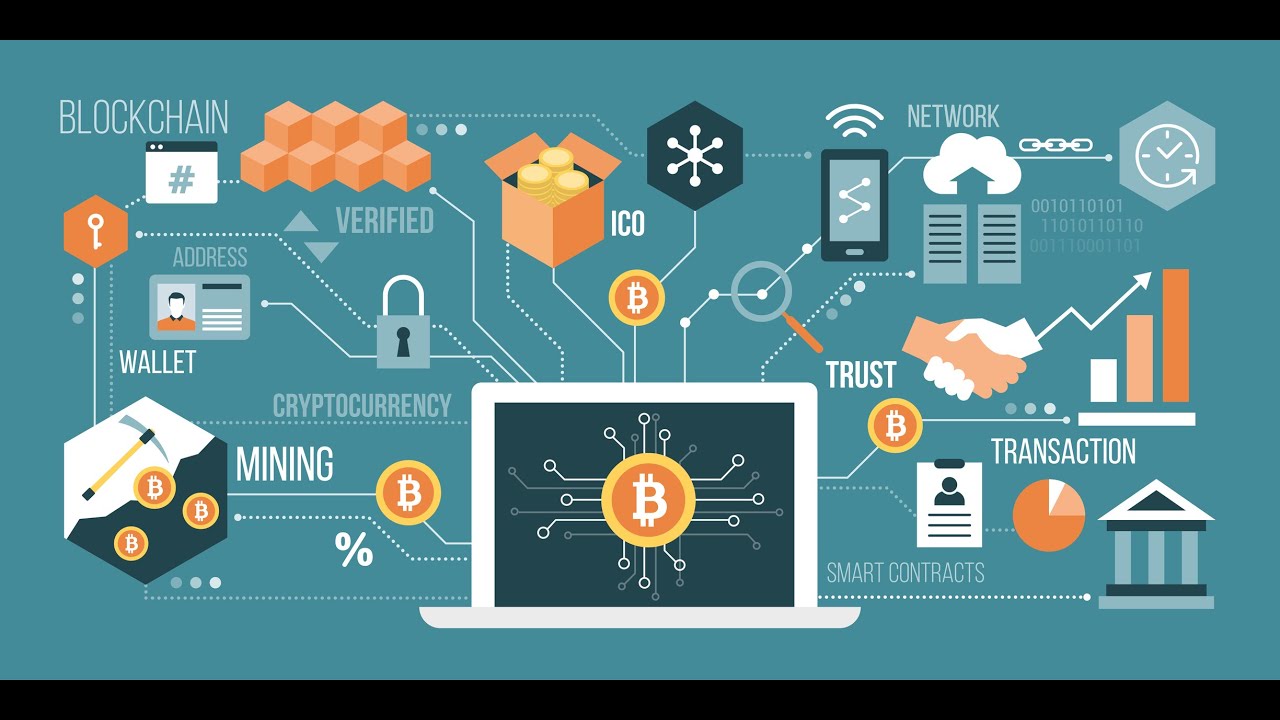

Blockchain Solutions for Fintech to Ensure Security and Transparency

We build blockchain-based systems for fintech startups and financial institutions, including tokenized asset platforms, smart contracts, KYC chains, and decentralized finance solutions.

Secure, Scalable, and Compliant Blockchain Architecture for Financial Innovation

Blockchain isn’t just a buzzword in fintech — it’s the backbone of tomorrow’s financial infrastructure. From digital identity to real-time settlement, the power of distributed ledgers lies in eliminating friction, enhancing trust, and reducing operational overhead.

At Datalabs Solutions, we develop blockchain-powered fintech applications that redefine how financial transactions are executed, verified, and secured.

Our blockchain solutions enable instant cross-border payments, smart contract automation, and tamper-proof audit trails, creating transparent, trust-based ecosystems for banks, startups, and investors.

Partnering with global blockchain frameworks like Ethereum, Hyperledger Fabric, and Polygon, we build scalable decentralized solutions that comply with financial regulations.

Backed by our expertise in Smart Contract Development and Cloud Infrastructure, we help fintechs innovate securely while maintaining full transparency and compliance.

Whether you’re launching a decentralized app, modernizing an internal audit process, or building the infrastructure for tokenized lending, we engineer blockchain solutions with performance, governance, and compliance at the core

Where Blockchain Delivers the Most Value in Fintech

We help fintechs unlock efficiency and transparency across asset flows, customer data, and cross-platform integrations.

- ✅ Asset Tokenization & Smart Contract Deployment

- ✅ Blockchain-Based KYC/AML Systems

- ✅ Audit Trail & Regulatory Ledger Automation

- ✅ NFT Infrastructure for Financial Assets

- ✅ Chain Interoperability (Ethereum, Polygon, BNB, Quorum)

- ✅ DeFi Protocol Integration & Liquidity Management

- ✅ Real-Time Payment Settlements (B2B & Cross-Border)

- ✅ Enterprise Blockchain Networks (via IBM, Hyperledger, Azure)

- ✅ Escrow Smart Contracts & Custodial Wallet Flows

- ✅ Salesforce & ERP Integration with Blockchain APIs

We begin by identifying your operational and regulatory requirements — whether you’re tokenizing loan products, enabling digital wallet transfers, or replacing Excel-based audits with blockchain traceability.

Our architects design an end-to-end stack: smart contract logic, blockchain database setup, chain selection, and front-end integration. We use frameworks like Hyperledger Fabric, Solidity, and Microsoft Azure Blockchain Services for enterprise-grade security, speed, and scalability.

Once deployed, your team gains access to real-time dashboards, multi-signature controls, and a blockchain explorer interface. All nodes are secured, APIs are documented, and compliance audit trails are embedded into the ledger for reporting and oversight.

Have Questions? We’ve Answers

Answer to your Queries

Which blockchain platforms do you work with?

We support Ethereum, Polygon, Hyperledger, Quorum, IBM Blockchain, and Microsoft Azure Confidential Ledger.

Can blockchain improve regulatory compliance?

Yes. We use blockchain to create immutable, real-time audit trails, reduce reporting errors, and secure KYC/AML data exchanges.

Do you build tokenized platforms for real-world assets?

Absolutely. We support token creation, wallet integration, smart contract development, and exchange integrations.

Is your solution suitable for both Web3 and traditional finance?

Yes. We build hybrid systems for neobanks, lenders, payment platforms, and decentralized finance startups.

How long does a blockchain fintech project take to launch?

MVPs typically take 4 to 8 weeks. Full platform rollouts depend on compliance scope, integrations, and chain architecture.